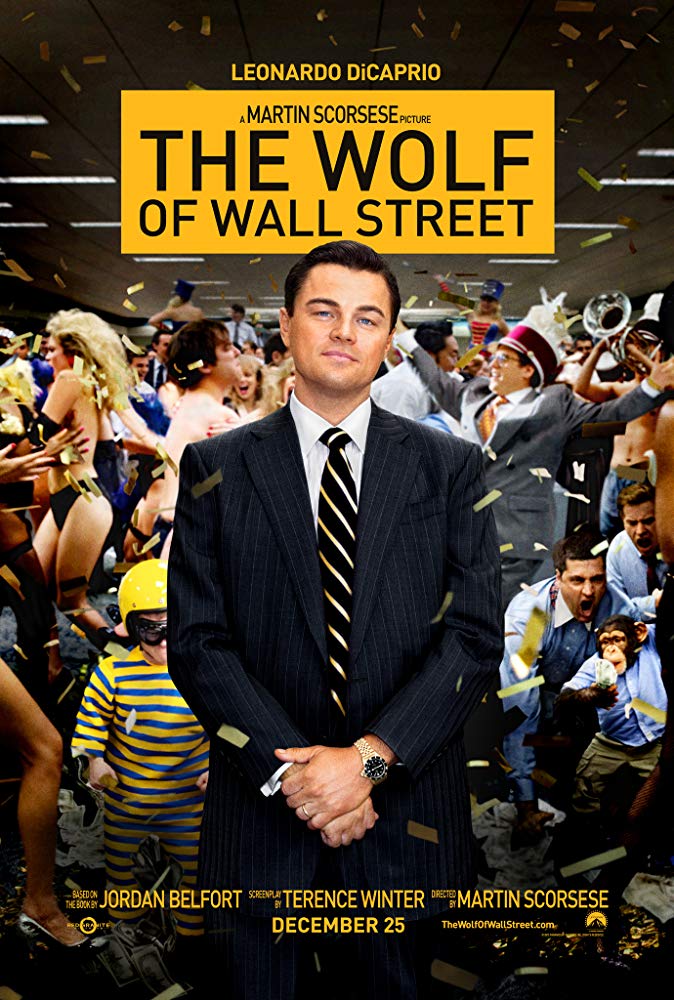

Movie Of The Month: The Wolf Of Wall Street

This October, I’ve had the joy of watching the 2013 film, the Wolf Of Wall Street via Netflix, starring Leonardo DiCaprio and directed by Martin Scorsese.

Despite the film showing vile language, obscene themes, drugs and liquor, at the very core there are some INVESTING LESSONS to be learned.

And that’s what I’m going to share with you today.

Wolf Of Wall Street Overview

The film is a true story about Jordan Belfort (played by Dicaprio), who started as a young and ambitious stock broker at Wall Street.

One day, the stock brokerage firm he was working with eventually CLOSED SHOP due to an economic crisis. He suddenly found himself out of a job.

Desperate to get employed, he found a job in a shady garage operation that sells PENNY STOCKS to unsuspecting, easy-to-fool buyers. (Penny stocks are stocks with little to no value, except for being literally cheap at cents apiece).

Jordan made a lot of money in that garage operation, thanks to his high pressure sales tactics. A few months later, he was able to strike out on his own, hire a few of his friends, and start his own stock brokerage business and become known as the ‘Wolf OF Wall Street’.

The company he built later made more money than he could imagine….BUT at the same time, they are doing stuff that are bordering on the illegal and that rips off investors.

It would only be a matter of time until the Wolf Of Wall Street would suffer the consequences of his actions…

Lessons From The Wolf Of Street

Lesson #1: Never Buy Stocks Based Only on Your Stock Broker’s Tips

This is a big one. In the movie, lots of investors lost money because they bought worthless stocks based only on Jordan Belfort’s sales-driven recommendations.

I’m not saying that all stock brokers are dishonest. I’m just saying that they are making commissions from your purchases, and that’s why SOME of them don’t have your best interests in mind.

Even our favorite stock broker, COL FINANCIAL, gives out regular stock picks and recommendations based on their extensive research. Use those tips as guidelines, and not your only basis for buying stocks.

Do your due diligence before buying any stock, and take responsibility for your purchases in the event that the investment loses money.

Lesson #2: Never Assume That Stocks That Dramatically Increase In Price Will ALWAYS Continue to Increase

In the movie, Jordan Belfort’s company sold an initial public offering (IPO) to the public, called the Steve Madden IPO.

Thanks to Belfort’s high pressure sales tactics again (and his team of 1,000+ stock brokers who sold the same stock), the Steve Madden IPO achieved record levels of price in a very short period of time.

Everyone just assumed that the stock will continue to increase.

But boy they are wrong.

One day, Steve Madden suffered a steep decline in the stock market. The major correction started a chain reaction among its investors, and mass selling began.

This caused the stock price to go down dramatically all of a sudden, until it went all the way down to rock bottom. Thousands of investors lost their hard earned money and eventually sued Jordan Belfort for misleading them.

Beware of stocks that go up too soon in price….when it falls, it could happen in an instant as well.

Lesson #3: Buy Stocks With The Right Expectations

Many of the investors who lost money from the stocks that Jordan Belfort sold them did NOT set the right expectations.

Yes, Belfort was a high pressure sales person (bordering on being a con man). But it takes two to tango, as they say.

In Tagalog terms, “Walang makakapanloko kung walang magpapaloko”.

In short, the investors thought that buying stocks will result in getting rich very quickly.

Never ever set that expectation on any stock investment — regardless of what other people might tell you.

Conclusion

So there you have it, the investing lessons from The Wolf Of Wall Street. It’s a good thing to see the bad effects of irresponsible investing in a movie, so you no longer need to experience it in real life.

But despite this, I admire the REAL Jordan Belfort in real life. He made some mistakes in the past and even got jail time for it (lost his marriage too), but he was a great salesperson and he understood the stock market game better than the average person.

Today, he does sales training and only deals in legitimate businesses. You can search for him at Youtube if you’re interested. Just approach it with an open mind and don’t take anyone’s word at face value.

And if you like, you can hop over to Netflix and watch the Wolf Of Wall Street movie in your free time. Just don’t forget to put the children to bed first. It’s one heck of a ‘dirty’ movie. (HAHAHA)